The holiday season is now upon us, bringing a sense of warmth and joy as we embrace the final month of the year. December invites us to gather with loved ones, reflect on the shared moments, and look ahead to new beginnings. It’s a time for creating memories, spreading kindness, and enjoying the season’s simple pleasures. Here’s to a month full of peace, celebration, and heartfelt connections.

The holiday season is now upon us, bringing a sense of warmth and joy as we embrace the final month of the year. December invites us to gather with loved ones, reflect on the shared moments, and look ahead to new beginnings. It’s a time for creating memories, spreading kindness, and enjoying the season’s simple pleasures. Here’s to a month full of peace, celebration, and heartfelt connections.

You have our very best!

Jackie and Kristine

Hartnell College and Cal State Monterey Bay launched

new degree pathway program at

a signing ceremony on Oct. 31

Hartnell College and Cal State Monterey Bay (CSUMB) are excited to announce the launch of the Panther Otter Pathway (POP) Program, a groundbreaking collaboration designed to make earning a bachelor’s degree more accessible for students. The new program creates a streamlined path for first-time, first-year students who may not meet CSU entrance requirements directly after high school. Students in the POP Program will be simultaneously admitted to Hartnell College and CSUMB, allowing them to earn an Associate Degree for Transfer at Hartnell and secure guaranteed admission to CSUMB. This partnership simplifies the process, enabling students to apply to both institutions with one unified application.

The POP Program aims to boost graduation rates, provide students with a clear and supportive pathway to higher education, and prepare them for rewarding careers. By offering seamless transitions from community college to a four-year university, this initiative helps promote economic mobility and strengthens local communities. “This program further enhances social mobility and streamlines the process for students to continue their studies with us once they complete their associate degrees,” said CSUMB President Vanya Quiñones. Hartnell College President Michael Gutierrez echoed this sentiment, emphasizing that the goal is to remove barriers to higher education and ensure students’ success from start to finish.

Both college presidents attended a joint signing ceremony on October 31 at CSUMB’s Otter Student Union to celebrate this exciting milestone. The Panther Otter Pathway Program represents a vital step forward in supporting students’ educational journeys and fostering economic growth in the region. Click here to read more.

David Rodríguez Muñoz

Disillusioned with school as a teenager in East Salinas, David Rodríguez Muñoz dropped out and earned his GED before working at Taylor Farms, packaging salads.

One late night in the company cafeteria, David realized he didn’t want to continue down that path indefinitely. Though unsure of his next steps, he knew he needed to find a career that resonated with him. This led him to Hartnell College, where, after some initial struggles, he discovered his talent for photography. His photography teacher, Eric Bosler, was pivotal in nurturing David’s interest and helping him find his focus and pathway. David credits Bosler as the “glue that kept him together” throughout his journey at Hartnell. Click here to read more.

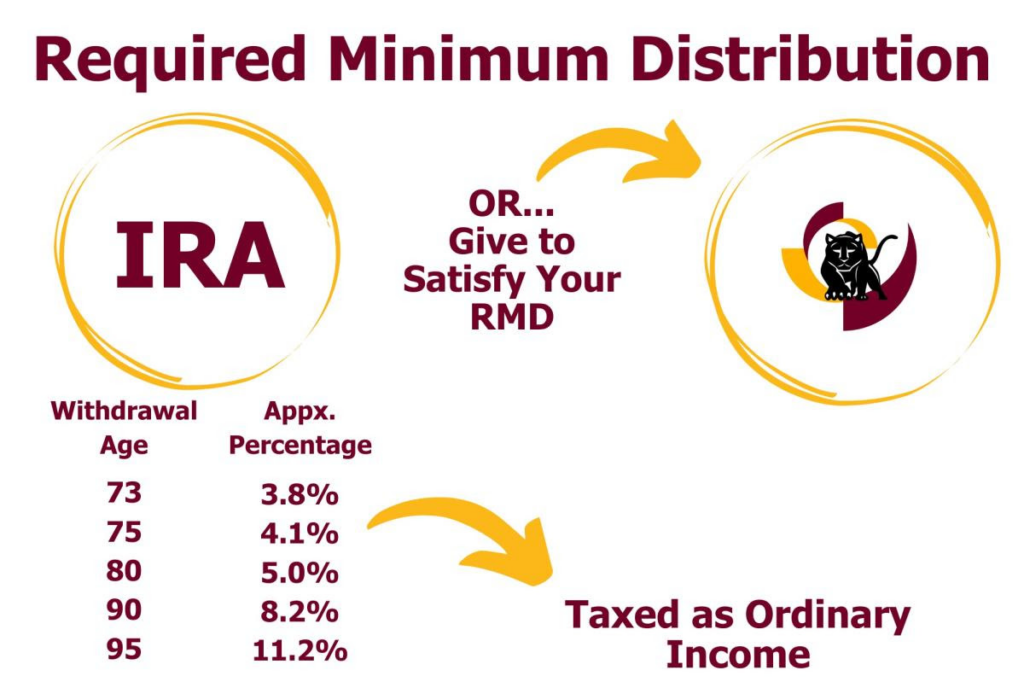

One Gift of Appreciated Stock = Two Tax-Savings Benefits

Consider this: you own stock that’s grown in value over the years. Selling it for cash to make a donation is fine, but there’s a more impactful, thoughtful option—one that stretches your generosity and redirects your tax money away from the IRS and towards the Mount.

Here’s the opportunity:

When you donate appreciated stock directly to the Mount, you unlock two powerful benefits.

First, you get an income tax deduction for the full market value of the stock—just like cash gifts, if you itemize your deductions.

Second—and here’s the magic— you avoid the capital gains tax entirely. Normally, selling that stock would trigger a tax bill on the growth, but by donating it, you eliminate that tax burden.

It’s a win-win. Your generosity fuels life-changing work at the Mount while your gift goes further—maximizing impact for both the mission and your finances.

Think beyond the usual. Your stock portfolio isn’t just an investment; it’s a tool for creating change.

For more information, please visit our website.

Request Your Estate Planning Guide

If you are thinking about giving the Hartnell College Foundation an estate gift from your will or trust, please contact us or learn more on our website.

If you want a free estate planning guide, please click here.

Our very best!

Dr. Jackie Cruz, Ed.D.

Vice President of Advancement and Development

Executive Director, Hartnell College Foundation

jcruz@hartnell.edu

(831) 444-2446 mobile

Kristine Edmunds

Director of Philanthropy

Hartnell College Foundation

(831) 755-6903 Office

(831) 601-0016 Mobile

kedmunds@hartnell.edu

When Emmett Linder graduated from Hartnell College in 1977, he had no idea the impact he would make on the college district years later. Born and raised in Salinas, Linder is one of five boys and all of them attended Madonna del Sasso and Palma.

When Emmett Linder graduated from Hartnell College in 1977, he had no idea the impact he would make on the college district years later. Born and raised in Salinas, Linder is one of five boys and all of them attended Madonna del Sasso and Palma.

As we dive into the heart of summer, July brings a vibrant blend of sun-soaked days and starry nights, perfect for beach trips, backyard barbecues, and fireworks. This month is about celebrating freedom, embracing warmth, and creating unforgettable memories with family and friends. So, let’s soak up the sun, enjoy the longer days, and make the most of everything this lively month offers. Here’s to a fantastic July filled with fun, relaxation, and a touch of adventure!

As we dive into the heart of summer, July brings a vibrant blend of sun-soaked days and starry nights, perfect for beach trips, backyard barbecues, and fireworks. This month is about celebrating freedom, embracing warmth, and creating unforgettable memories with family and friends. So, let’s soak up the sun, enjoy the longer days, and make the most of everything this lively month offers. Here’s to a fantastic July filled with fun, relaxation, and a touch of adventure!