Dear donors and supporters,

Dear donors and supporters,

It’s go time for us here at Hartnell College as the new academic year has begun! This is always my favorite part of working here – seeing the flood of students through the hallways and throughout the campus is exhilarating.

Thanks to your support, the Hartnell College Foundation is dispersing thousands and thousands of dollars in scholarships to students who need this extra supplemental aid to cover expenses. Our goal is to support the students so they can better focus on their academic life and not worry about financial challenges.

Another way to see your dollars in action is through programs like WELI and MILE. For the Hartnell staff in the Office of Equity Programs, witnessing the leadership institute for both groups was a true honor and privilege. It was great to see the scholars connect and bond with each other and connect with their facilitators and guest speakers. Each one came to the institute with their own life experiences and challenges, and all walked away with a toolbox of new strategies to use for success.

I am happy to provide a recap of their first three-day institute below and to introduce two of our amazing scholars.

Be well,

Jacqueline Cruz

Vice President of Advancement and Development

Executive Director, Hartnell College Foundation

(831) 444-2446 mobile

LEADERSHIP INSTITUTES COMMENCE

WELI and MILE are off to a great start

The leadership institutes are off to a great start at Hartnell College. The Women’s Education & Leadership Institute and the Men’s Institute for Leadership & Education met for a three-day institute in mid-August on the main campus.

The leadership institutes are off to a great start at Hartnell College. The Women’s Education & Leadership Institute and the Men’s Institute for Leadership & Education met for a three-day institute in mid-August on the main campus.

“Both sessions were phenomenal,” said Dr. Gabriela Lopez, Director, Office of Equity programs. “The scholars arrived ready to learn and to connect.”

The women’s group was expertly led by facilitator Nena Anguiano, who helped them identify their ‘Circle of Success’ and created opportunities for students to connect with each other. The men’s group was led by Dr. Fred Moore, who guided them through his ‘I am Self-Actualized’ curriculum, which included topics such as compassionate listening, self-awareness, and communication skills.

The institutes were a powerful experience for the scholars. Both men and women shared parts of their personal journey and connected in a personal way.

“Despite diversity in age, lived experiences, and languages spoken, scholars created connections with each other and found common ground,” said Dr. Lopez. “WELI scholars also received presentations from Dr. Annette Oswald on the topic of Resilience, and Counselor Gemma Uribe-Cruz on Emotional Intelligence and self-care.”

One of the MILE scholars is Andy Garcia Ortiz, 21, from Seaside, CA. He is majoring in Welding & Construction Management, and is adding new majors in Diesel Technology and Mechatronics. He has always been CTE (Career Technical Education) driven.

“My parents have always shown me that hard work is required to be successful in life,” he said. “I enjoy working with my hands and hope to one day be an engineer.”

He is thankful for the opportunity to be a part of MILE and the cohort of 25 scholars. He said that Dr. Moore used positivity to inspire them to hold themselves accountable, and talked about the real meaning of ‘being a man,’ emotional intelligence, anger management, perseverance, and more.

For Andy, his faith is key in navigating life, and he feels that it is his duty to advocate and lead others to opportunities like MILE and other programs offered at Hartnell.

“I want to thank donors and those involved with MILE because they are investing time and money in the next generation, which will be in charge of taking care of them in retirement,” he said.

A similar experience was happening on the other side of campus for 50 WELI scholars. Amaris Santiago, 19, thought it was the greatest thing to be a part of a women’s institute. She is entering her sophomore year at Hartnell and plans to transfer to a university next year to become an elementary teacher.

“It was great to meet women in different disciplines and interests,” she said. “On our first day, we were sharing our lives with each other and exchanging contact information.”

She is used to hard work through the example of her parents, who are pastors at a local church in Salinas. She is involved in leadership and is part of the worship team. For her, this was an experience that made her feel empowered.

“I am overwhelmed with a lot of joy after this first institute,” she said. “I feel like I am not alone, I feel supported, and that I am here for a reason.”

Dr. Lopez said that the timing of the institute was perfect as it prepared students to begin the new academic year with a sense of energy and confidence, knowing they have a network of peers and mentors supporting them.

“In a time where personal connections can be a challenge due to our reliance on technology, being able to take three days to connect with a group of peers was a valuable experience,” said Dr. Lopez. “I am excited that they will be connecting with their professional mentors soon so they can keep the momentum going.”

RMDs

Guide to Required Minimum Distributions

After years of saving, you’ve built a solid nest egg in your tax-advantaged retirement accounts. But you can’t leave that money untouched indefinitely.

After years of saving, you’ve built a solid nest egg in your tax-advantaged retirement accounts. But you can’t leave that money untouched indefinitely.

Required Minimum Distributions, frequently referred to as RMDs, are how the federal government collects taxes from savings held in tax-deferred retirement plans. RMD rules require you to start withdrawing a set amount of money each year, whether you need the income or not.

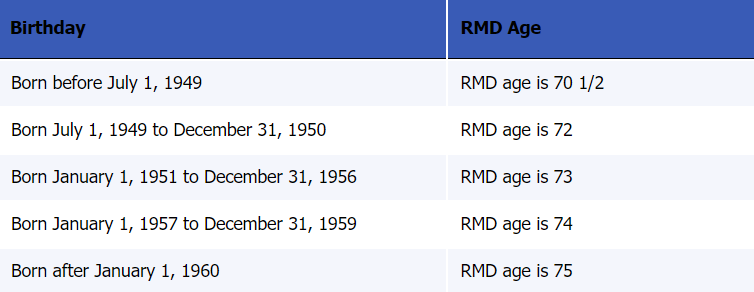

Recent changes to the RMD rules expand the year at which you must start taking distributions, between 72 and 75, depending on the year of your birth.

An RMD is the amount of money that you must withdraw from nearly all types of tax-deferred retirement accounts each year once you hit a certain age.

Many retirement accounts let your savings grow tax-free over the decades, deferring the payment of income taxes until you begin making withdrawals in retirement.

By requiring you to start taking money out, the government receives the tax revenue it’s been waiting for and also ensures taxpayers aren’t accumulating tax-free wealth indefinitely.

As the name suggests, this amount is a minimum—you can always withdraw more. You can also withdraw funds from accounts and invest the money elsewhere before your RMD age hits so as to reduce the amount you must take out later.

Before 2019, RMDs began in the year you turned 70 ½. In 2019, the SECURE Act raised the RMD age to 72. The Secure Act 2.0 raised the RMD age again, based on your birthday as shown in the table above.

What will your legacy be?

If you are thinking about naming the Hartnell College Foundation in your estate plans, contact either our Vice President of Advancement and Development/Executive Director for the Foundation, Jackie Cruz at jcruz@hartnell.edu or call (831) 444-2446, or our Director of Philanthropy, Kristine Edmunds at kedmunds@hartnell.edu or by phone at (831) 755-6903. To make a gift in support of Hartnell students, go to: https://