Give from Your IRA and Help Satisfy Your RMD for the Year

Giving from Your IRA Distribution

Can Be a Smart Move

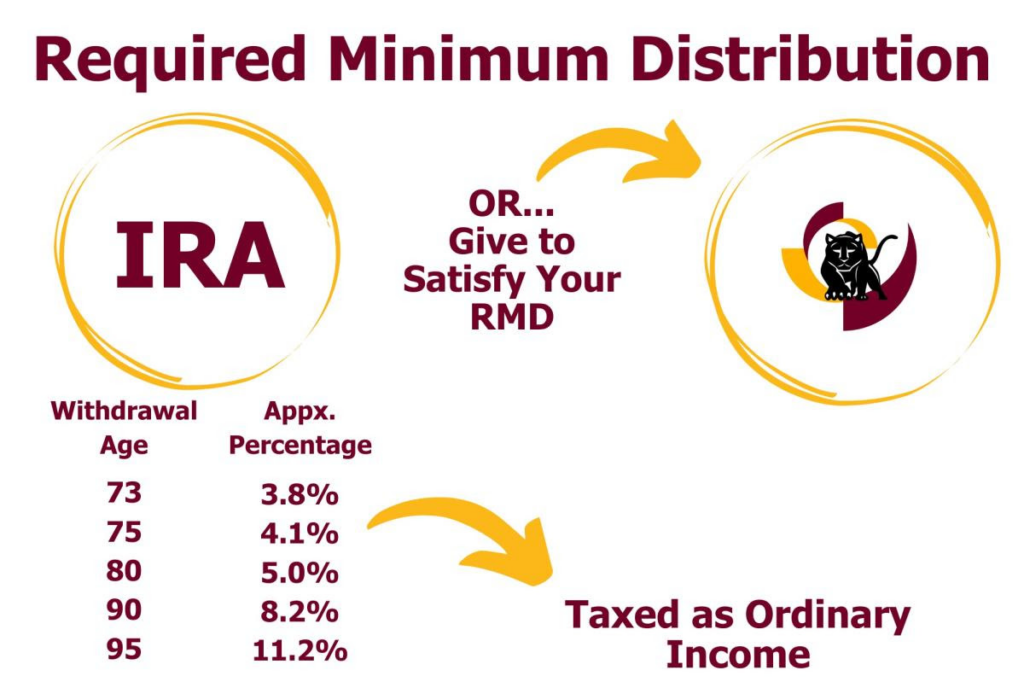

You may be looking for a way to make a big difference to help further our mission to champion student success. When you invest in a traditional IRA, you are building your retirement with pre-taxed dollars. The government taxes you only when you withdraw from your account. You can start withdrawing money from your IRA penalty-free at age 59 1/2. However, once you reach age 73, the government requires you to withdraw at an increasing percentage each year (please see table below). This mandatory withdrawal is called a Required Minimum Distribution (RMD). If you make a withdrawal, you will be taxed based on your ordinary income. If you don’t make a withdrawal, you will be penalized upwards of 50% of that you do not withdraw.

Suppose you only need some of your IRA income and are charitably inclined. In that case, you can donate directly from your IRA to a qualifying public charity (501(c)(3)), such as Hartnell College Foundation, starting at age 70 1/2. This Qualified Charitable Distribution lets you give up to $105,000 annually without making a required withdrawal or paying income tax on your gift. In addition, your gift may fully satisfy your RMD for the year. It’s a win-win scenario, especially if you want to support a nonprofit like Hartnell College Foundation.

To learn more about the benefits of giving directly from your IRA, please vist our website.

Our very best!

Dr. Jackie Cruz, Ed.D.

Vice President of Advancement and Development

Executive Director, Hartnell College Foundation

(831) 444-2446 mobile

jcruz@hartnell.edu

Kristine Edmunds

Director of Philanthropy

Hartnell College Foundation

(831) 755-6903 Office

(831) 601-0016 Mobile

kedmunds@hartnell.edu

eNewsletter

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

News

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- AN ADVOCATE FOR AG EDUCATION Emmett Linder

- Our Students & Your Generosity Create a Better Community

- Give from Your IRA and Help Satisfy Your RMD for the Year

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Give and Receive with a Charitable Gift Annuity

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community

- Our Students & Your Generosity Create a Better Community